IRS 668(Z) 2000-2026 free printable template

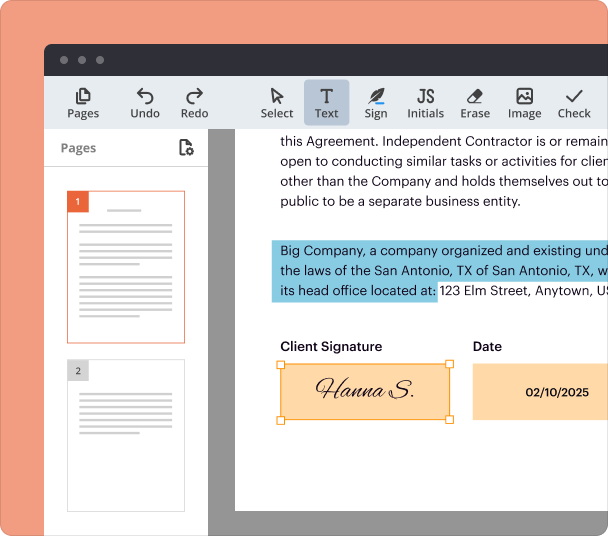

Fill out, sign, and share forms from a single PDF platform

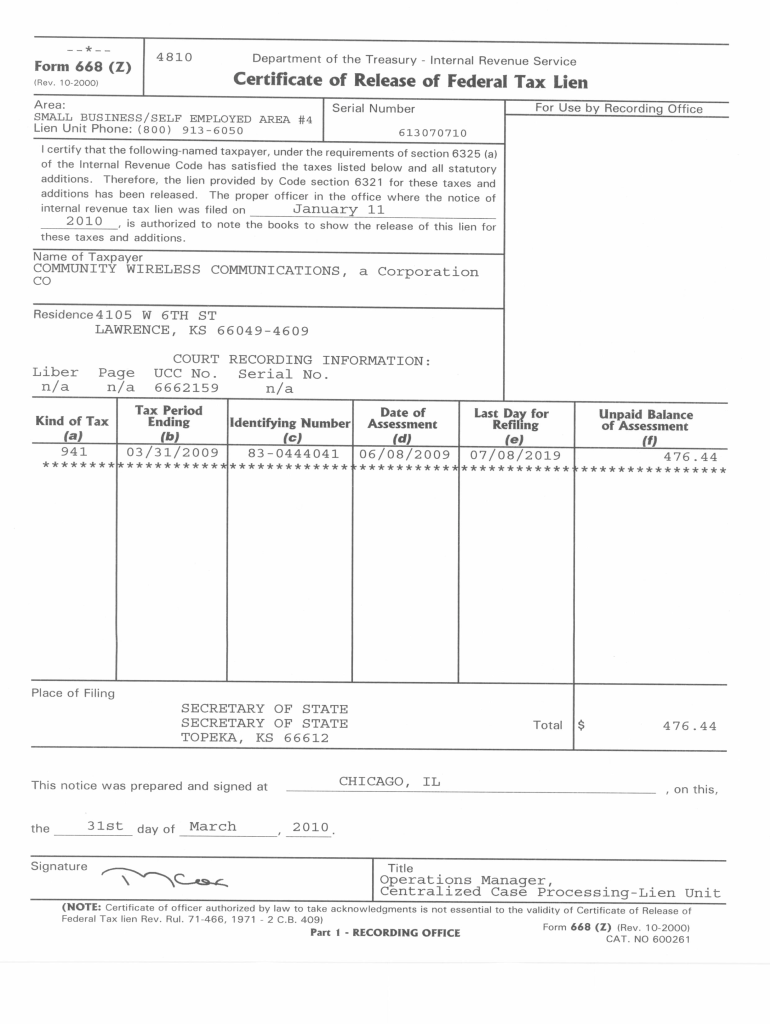

Edit and sign in one place

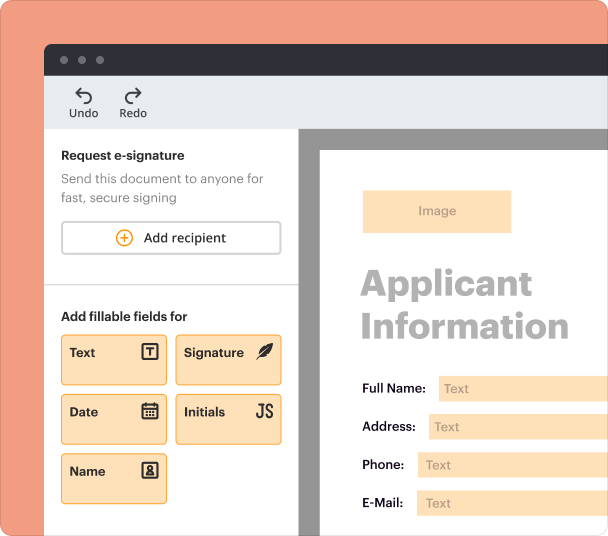

Create professional forms

Simplify data collection

Manage forms centrally

Why pdfFiller is the best tool for your documents and forms

End-to-end document management

Accessible from anywhere

Secure and compliant

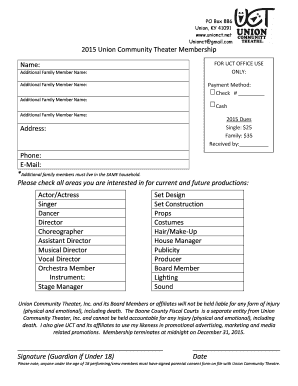

Comprehensive Guide to the IRS 668Z 2 Printable Form

Understanding the IRS 668Z 2 Printable Form

The IRS 668Z form is a crucial document used for releasing federal tax liens. The form serves as an official declaration from the IRS that a tax lien on your assets has been lifted. This is an essential step for individuals and businesses looking to clear their financial records of federal tax liabilities.

Key Features of the IRS 668Z Form

The IRS 668Z form includes several important features: it provides detailed information regarding the taxpayer, outlines the specifics of the lien being released, and serves as an official record for both the IRS and the taxpayer. Additionally, the form is versatile, applicable for various situations in which a lien exists due to unpaid taxes.

When to Use the IRS 668Z Form

You should use the IRS 668Z form when you have paid your tax debt and are seeking the removal of a federal tax lien. This form is a necessary tool to formally request that the IRS acknowledges the fulfillment of your tax obligations and releases any claims they may have against your property.

Eligibility Criteria for the IRS 668Z Form

To be eligible to use the IRS 668Z form, you must have satisfied all requirements concerning your tax liabilities. This includes paying the owed amount in full or reaching a settlement with the IRS. Instances such as qualifying for the IRS Fresh Start Program may also affect your eligibility.

How to Fill Out the IRS 668Z Form

Filling out the IRS 668Z form requires attention to detail. First, provide your personal information, including your name, address, and Social Security number. Next, correctly identify the lien you are requesting a release for by referencing the case number associated with it. Ensure that all fields are accurately completed to prevent processing delays.

Common Errors to Avoid with the IRS 668Z Form

Common mistakes when completing the IRS 668Z form include incorrect personal information, missing signatures, and failure to include necessary documentation. Always double-check your information and consult the IRS guidelines to ensure accuracy. Taking the time to review your submission can help avoid unnecessary complications.

Submission Methods for the IRS 668Z Form

Once the IRS 668Z form is completed, it can be submitted to the IRS in several ways. Many taxpayers choose to mail the form directly, while others might prefer to submit it electronically, depending on IRS capabilities. Always check the latest IRS guidelines for any updates on submission methods.

Frequently Asked Questions about irs form 668 z

What is the purpose of the IRS 668Z form?

The IRS 668Z form is used to officially request the release of a federal tax lien once the tax obligation has been met.

Who is eligible to file the IRS 668Z form?

Eligibility to file the IRS 668Z form is generally for individuals or businesses that have paid off their tax liabilities or have arranged for their payment.

pdfFiller scores top ratings on review platforms