IRS 668(Z) 2000-2025 free printable template

Show details

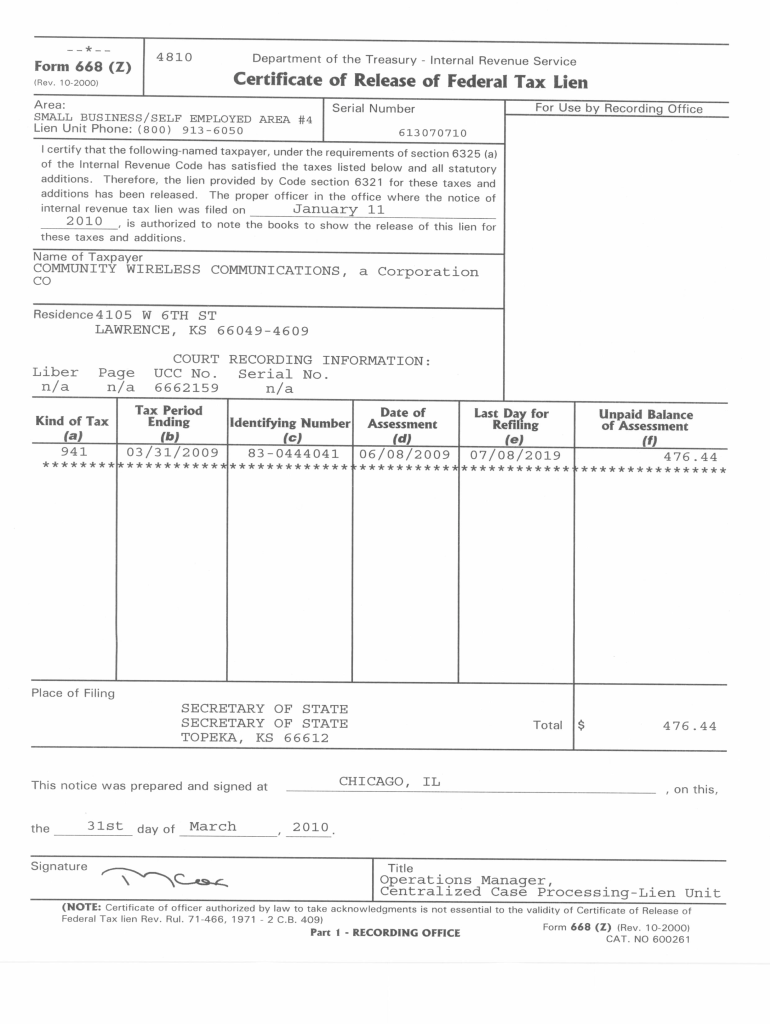

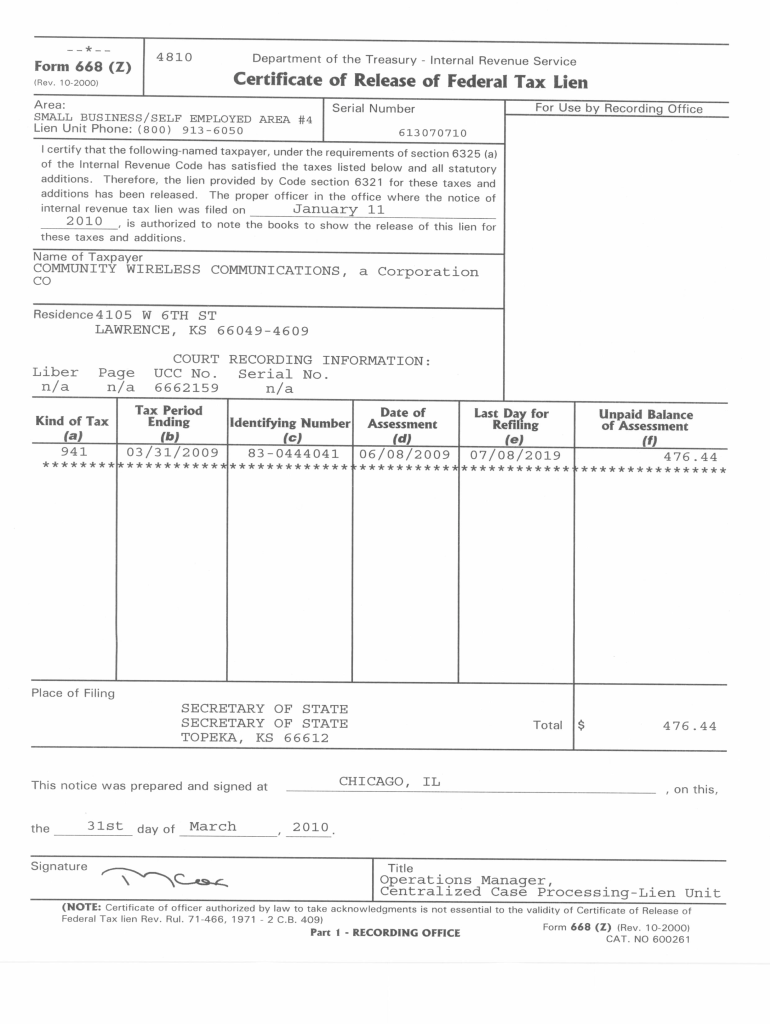

Department :1: the Tree — internal Revenue Eerie. Cert?came of Release EF Federal Tax Lien ere-a: Serial Number Fer Use kw Fl'MRI?g ??ice. SMALL- ...

pdfFiller is not affiliated with IRS

Get, Create, Make and Sign irs form 668 z release of federal tax lien

Edit your form 668 z form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your publication 4235 advisory group addresses form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit irs publication 4235 online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 668 z irs form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out irs form 668 y

How to fill out IRS 668(Z)

01

Obtain the IRS Form 668(Z) from the official IRS website or local IRS office.

02

Begin with the taxpayer's information, including name, address, and taxpayer identification number.

03

Fill out the 'Notice of Federal Tax Lien' section, specifying the relevant tax period and the amount owed.

04

Make sure to check all required boxes to indicate the nature of the tax liability.

05

Include any necessary supporting documentation that substantiates the lien.

06

Review all information for accuracy and completeness before submitting.

07

Submit the completed form according to the IRS guidelines, either through mail or electronically if applicable.

Who needs IRS 668(Z)?

01

Individuals or entities that owe federal taxes and have a tax lien filed against them.

02

Taxpayers who wish to formalize the process of a federal tax lien release.

03

People who are involved in tax disputes and need to respond to IRS actions regarding their tax liability.

Fill

irs tax lien withdrawal

: Try Risk Free

People Also Ask about what is irs form 668 z

What is a Form 668 C final demand for payment?

The Service issues a Form 668-C, Final Demand, when a levy source in possession of the taxpayer's property or rights to property has received the Service's Form 668-A, Notice of Levy, and has failed to respond timely.

What is a form 668 Z?

Form 668Z, Certificate of Release of Federal Tax Lien - (good) - is provided to the taxpayer upon request when the lien has been satisfied or otherwise released.

What is form 668 Notice of Federal Tax lien?

Form 668(Y)(c) - Notice of Federal Tax Lien is filed in the public record to let other creditors know that the IRS is claiming rights to your property. A lien is not a levy. A lien secures the government's interest in your property when you don't pay your tax debt.

How do I get proof of IRS lien release?

For a copy of the recorded certificate, you must contact the recording office where the Certificate of Release of Federal Tax Lien was filed. If the federal tax lien has not been released within 30 days of satisfying your tax liability, you can request a Certificate of Release of Federal Tax Lien.

What is a form 668 C final demand for payment?

The Service issues a Form 668-C, Final Demand, when a levy source in possession of the taxpayer's property or rights to property has received the Service's Form 668-A, Notice of Levy, and has failed to respond timely.

What is a Form 668 Y notice of federal tax lien?

This form is filed with local and/or state authorities to alert creditors that the government has an interest in your current and future property and assets.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in form 668z?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your irs form 668 z to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in form 13794 without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing irs form 668 z pdf and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out form 668 z pdf using my mobile device?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign form 668 y c and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

What is IRS 668(Z)?

IRS 668(Z) is a form used by the Internal Revenue Service to notify a taxpayer of a tax lien. It is a notice of federal tax lien that is filed to protect the government's interest in taxpayer's property.

Who is required to file IRS 668(Z)?

IRS 668(Z) is typically filed by the IRS against taxpayers who owe significant tax debts and have not made arrangements to pay. It is filed by the IRS to ensure that the lien is recorded in public records.

How to fill out IRS 668(Z)?

IRS 668(Z) is not filled out by taxpayers; rather, it is filled out by the IRS. The form includes details such as taxpayer information, outstanding tax liabilities, and describes the property that is subject to the lien.

What is the purpose of IRS 668(Z)?

The purpose of IRS 668(Z) is to formally establish a tax lien against a taxpayer's property in order to secure the government’s interest in collecting unpaid taxes.

What information must be reported on IRS 668(Z)?

IRS 668(Z) must report the taxpayer's name and address, the type of tax owed, the amount of the tax liability, and a description of the property subject to the lien.

Fill out your IRS 668Z online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Irc 6323 J is not the form you're looking for?Search for another form here.

Keywords relevant to irs irc 6325 a

Related to irs tax lien removal

If you believe that this page should be taken down, please follow our DMCA take down process

here

.